Supply Chain Finance Market Overview:

Maximize Market Research is a Business Consultancy Firm that has published a detailed analysis of the Supply Chain Finance Market. The report includes key business insights, demand analysis, pricing analysis, and competitive landscape. The report provides the current state of the Supply Chain Finance market by thorough analysis, and projections are made up to 2030.

Projected Growth Trajectory for Supply Chain Finance Market:

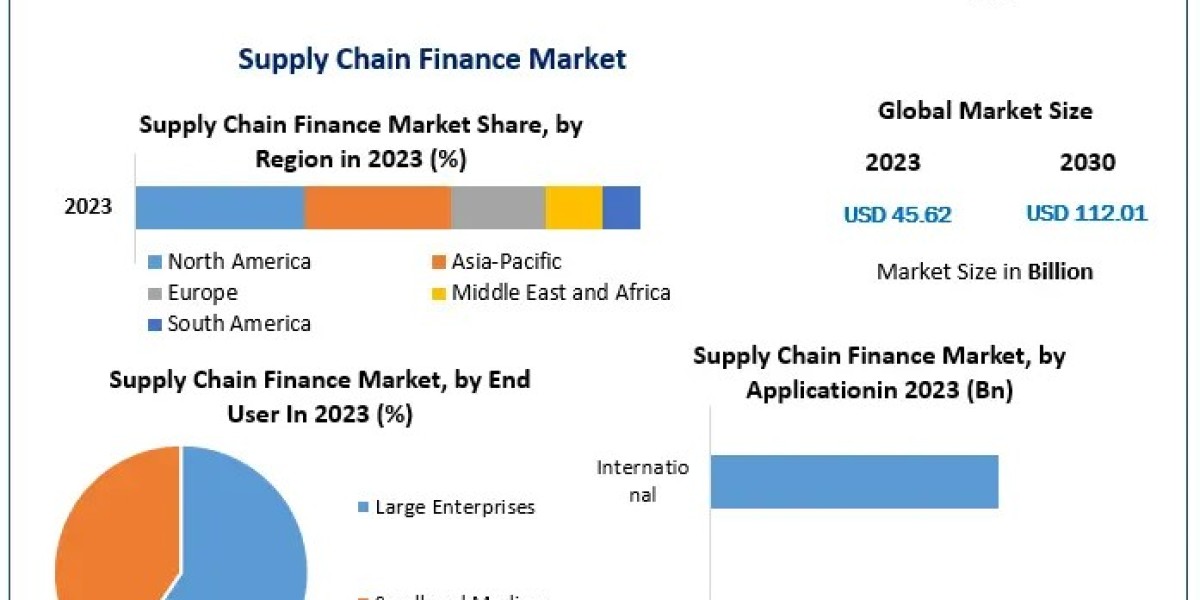

Supply Chain Finance Market was valued at USD 45.62 Billion in 2023 and is expected to reach USD 112.01 Billion by 2030, exhibiting a CAGR of 13.69 % during the forecast period (2024-2030)

Interested to take a sneak peek? Request a sample copy of the report to see what's inside:https://www.maximizemarketresearch.com/request-sample/168082/

Supply Chain Finance Market Scope and Methodology:

The approach that gives investors relevant information by combining descriptive analysis and SWOT analysis is covered in the study. Giving a complete picture of the Supply Chain Finance market is the study's main objective. The process of gathering data involves a variety of methods, such as questionnaires and surveys. After then, mathematical, statistical, and numerical techniques are used to evaluate the data. Gathering and categorizing data is crucial since a combination of qualitative and quantitative research methodologies are needed to identify Supply Chain Finance market trends.

The buyer-direct scenario, RD projects, innovative forms of development, cutting-edge industry practices, and market consolidations and acquisitions are all carefully examined in order to evaluate the potential futures of the market. Included in the research are charts, organizational portfolios, methods, and a critical evaluation of well-known corporate leaders. A thorough SWOT and PESTLE analysis was conducted on the Supply Chain Finance Market in order to pinpoint market trends and provide microeconomic factors.

Supply Chain Finance Market Regional Insights:

The Regional Analysis section displays the present state of the Supply Chain Finance market in each of the study's participating nations. Due to the complexity of the Supply Chain Finance business, local perspectives must be considered. North America, Europe, Asia-Pacific, Latin America, the Middle East, and Africa are the regions that comprise the Supply Chain Finance market. We extensively examine each research region's market size, growth rate, imports and exports, as well as other particular characteristics.

Request a sample copy of the report to see what's inside:https://www.maximizemarketresearch.com/request-sample/168082/

Supply Chain Finance Market Segmentation:

by Offering

• Export and Import Bills

• Letter of Credit

• Performance Bonds

• Shipping Guarantees

• Others

by Provider

• Banks

• Trade Finance House

• Others

The banks sector held the largest market share in 2021 with almost 85% of the worldwide supply chain finance market share, and it is expected that it would maintain its leading position over the projected period. Supply chain finance is a group of tech-based finance and business processes that enables all parties involved in a transaction to work together more efficiently and save money. Supply chain finance works best when the buyer can obtain financing at a lower cost and has a better credit rating than the supplier. However, throughout the course of the projected period, the trade finance house market is expected to grow at the highest rate—14%.

by End User

• Large Enterprises

• Small and Medium-sized Enterprises

by Application

• Domestic

• International

With about a quarter of the global market share in 2023, the domestic sector led the supply chain finance market. Over the course of the projection period, it is anticipated that this market segment will continue to hold the bulk of the market share. Over the course of the projected period, the abroad category is expected to see the fastest CAGR of 14.2%.

To access more comprehensive information, click here:https://www.maximizemarketresearch.com/request-sample/168082/

Supply Chain Finance Market Key Players:

• IBM

• Ripple

• Rubix by Deloitte

• Accenture

• Distributed Ledger Technologies

• Oklink

• Nasdaq Linq

• Oracle

• AWS

• Citi Bank

• ELayaway

• HSBC

• Ant Financial

• JD Financial

• Qihoo 360

• Tencent

• Baidu

• Huawei

• Bitspark

• SAP

• ALIBABA

For deeper market insights, peruse the summary of the research report:https://www.maximizemarketresearch.com/market-report/supply-chain-finance-market/168082/

Key questions answered in the Supply Chain Finance Market are:

- What growth strategies are the players considering to increase their presence in Supply Chain Finance?

- What are the upcoming industry applications and trends for the Supply Chain Finance Market?

- What are the recent industry trends that can be implemented to generate additional revenue streams for the Supply Chain Finance Market?

- Who are the leading companies and what are their portfolios in Supply Chain Finance Market?

- What segments are covered in the Supply Chain Finance Market?

- Who are the key players in the Supply Chain Finance market?

- Which application holds the highest potential in the Supply Chain Finance market?

- What are the key challenges and opportunities in the Supply Chain Finance market?

- What is Supply Chain Finance?

Latest cutting-edge research from Maximize Market Research is now trending:

Global Automotive Retrofit Electric Vehicle Power train Market https://www.maximizemarketresearch.com/market-report/global-automotive-retrofit-electric-vehicle-power-train-market/82047/

Global Optical Measurement Market https://www.maximizemarketresearch.com/market-report/global-optical-measurement-market/23199/

Key Offerings:

- Past Market Size and Competitive Landscape (2018 to 2023)

- Past Pricing and price curve by region (2018 to 2023)

- Market Size, Share, Size Forecast by different segment | 2024−2030

- Market Dynamics – Growth Drivers, Restraints, Opportunities, and Key Trends by Region

- Market Segmentation – A detailed analysis by segment with their sub-segments and Region

- Competitive Landscape – Profiles of selected key players by region from a strategic perspective

- Competitive landscape – Market Leaders, Market Followers, Regional player

- Competitive benchmarking of key players by region

- PESTLE Analysis

- PORTER’s analysis

- Recommendations

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Maximize Market Research: sales@maximizemarketresearch.com