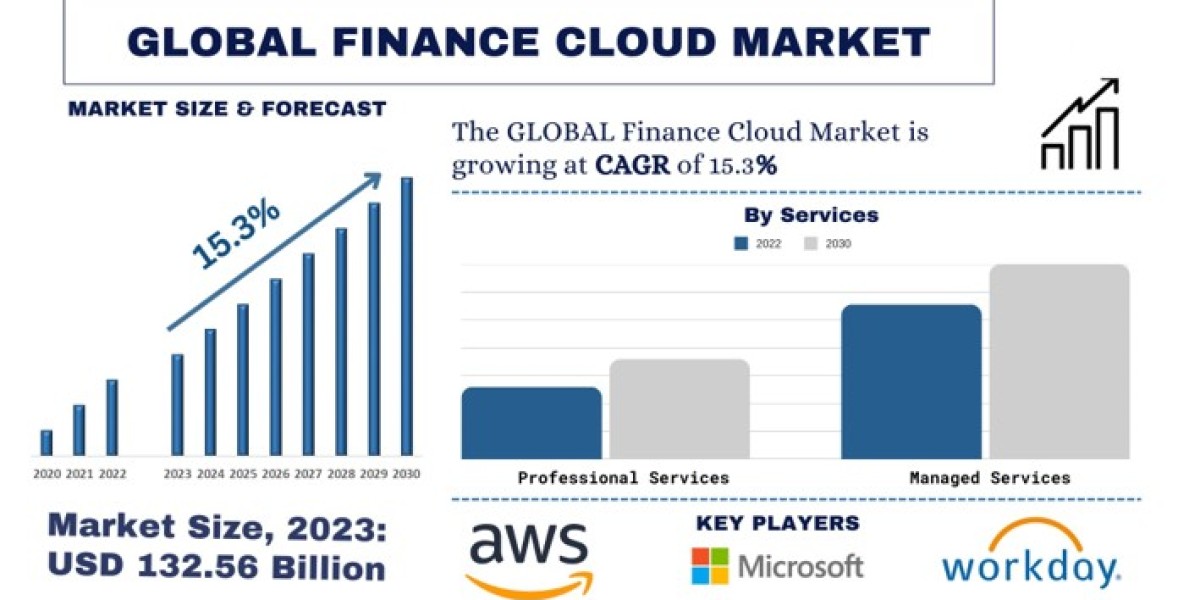

The finance cloud market is experiencing significant growth, driven by the increasing digitalization of the financial services industry. UnivDatos Market Insights estimates the market was valued at USD 132.56 billion in 2023 and is expected to reach USD 268.1 billion by 2028, with a Compound Annual Growth Rate (CAGR) of around 15.30%. This surge is attributed to several factors, including:

Access sample report (including graphs, charts, and figures): https://univdatos.com/get-a-free-sample-form-php/?product_id=58666

- Demand for Cloud-Based Solutions: Financial institutions are embracing cloud technologies to streamline operations, enhance scalability, and optimize costs. Traditional on-premises systems struggle to keep pace with evolving market demands and regulations.

- Cost-Effectiveness: Cloud solutions offer a pay-as-you-go model, eliminating the need for expensive upfront investments in hardware, software, and maintenance. This is particularly attractive for startups and small and medium-sized financial firms.

- Data Analytics: The financial services industry generates vast amounts of data. Cloud-based analytics platforms provide the tools to harness this data effectively, enabling institutions to gain valuable insights and make data-driven decisions.

Market Trends Shaping the Finance Cloud Landscape

- Security and Governance, Risk & Compliance (GRC): This segment is a major revenue generator due to the need for compliance with regulations like Basel III and GDPR. GRC solutions offer robust security features and help automate compliance processes.

- Focus on Risk Management: Financial institutions face various risks, and effective risk management is crucial. GRC solutions provide tools for risk assessment, modeling, and real-time monitoring to mitigate potential risks.

- Europe as the Growth Leader: Europe boasts the fastest-growing finance cloud market, with Germany and France leading the charge. This is due to a conducive regulatory environment like PSD2, which fosters innovation and open banking practices. Additionally, a collaborative ecosystem between fintech startups, traditional banks, and regulators creates a favorable environment for cloud migration. High cultural acceptance of digital innovation further fuels growth.

Click here to view the Report Description & TOC https://univdatos.com/report/finance-cloud-market/

Latest Market News and Developments

- October 2023: SAP introduced an upgrade to its Cloud for Banking platform with a new Anti-Financial Crime feature. This allows banks to address security threats, integrate real-time intelligence, and significantly reduce compliance costs.

- February 2024: Ericsson partnered with Hewlett-Packard Enterprise (HPE) to drive digital transformation in finance. Their collaboration integrates the Ericsson Wallet Platform with HPE GreenLake, offering cloud-based services for improved agility and scalability.

These trends and developments highlight the increasing importance of the finance cloud market. As financial institutions continue to embrace digitalization, the demand for cloud-based solutions is expected to rise significantly in the coming years.

Related Telecom & IT Market Research Report

Digital Human Avatar Market: Current Analysis and Forecast (2024-2032)

Virtual Influencers Market: Current Analysis and Forecast (2024-2032)

Diversity and Inclusion (D&I) Market: Current Analysis and Forecast (2024-2032)

Causal AI Market: Current Analysis and Forecast (2024-2032)

Contact Us:

UnivDatos Market Insights

Email - contact@univdatos.com

Contact Number - +1 9782263411

Website - https://univdatos.com/