The surgical sutures market has been experiencing steady growth as the healthcare industry continues to expand and modernize. Sutures are a staple in wound closure procedures and play a critical role in ensuring healing and recovery post-surgery. This market is not only thriving due to rising surgical procedures globally but also due to the continuous innovations in suture materials and techniques that are designed to improve patient outcomes and ease of use for healthcare providers.

In this market outlook, we explore the key growth drivers, emerging trends, and competitive landscape that are shaping the future of the surgical sutures industry.

Key Growth Drivers

The expansion of the surgical sutures market is largely driven by increasing surgical procedures globally, the rise of the aging population, and advancements in healthcare infrastructure, particularly in emerging markets. Additionally, minimally invasive surgeries are on the rise, creating a demand for sutures designed for smaller, more delicate incisions. As surgical interventions become more common to treat lifestyle-related diseases, injuries, and age-related conditions, the need for high-quality, reliable sutures remains a priority for healthcare providers.

The aging population is one of the most influential factors contributing to the rise in surgeries worldwide. Older adults are more susceptible to a range of conditions—from cardiovascular and orthopedic issues to complications related to chronic illnesses—often requiring surgical intervention. Consequently, the demand for wound closure products, particularly surgical sutures, has grown, reinforcing their market position as an essential element of the healthcare supply chain.

Advancements in Suture Materials and Technologies

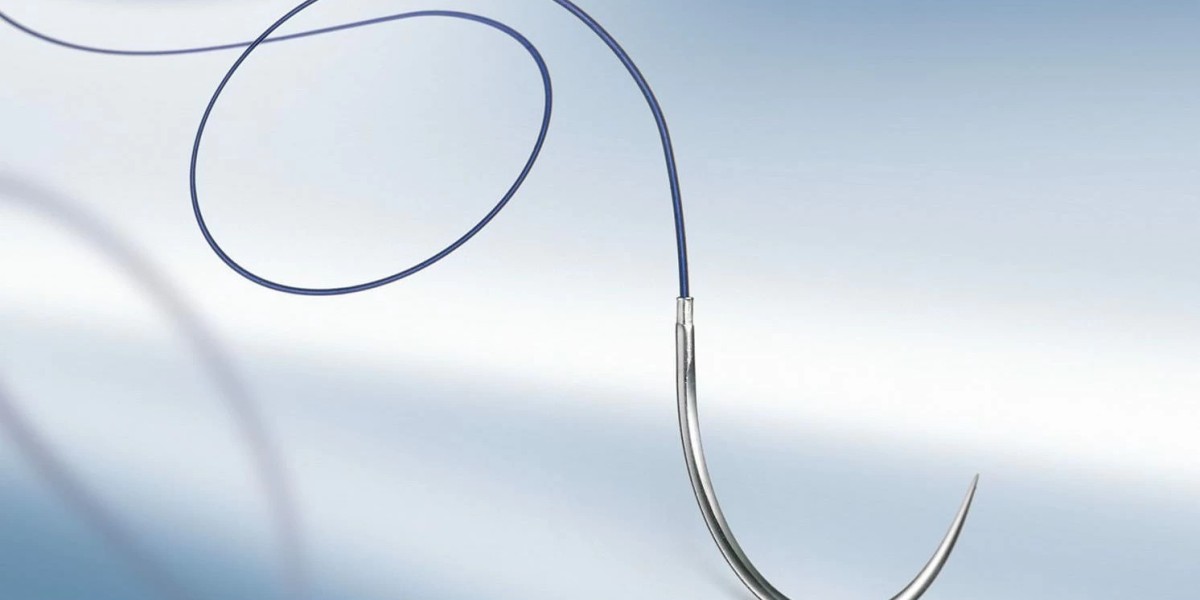

The market is experiencing significant shifts due to advancements in suture materials and manufacturing technologies. Traditional sutures, made primarily of materials like nylon and polypropylene, are being gradually replaced or supplemented by more advanced options. Biodegradable sutures, antimicrobial-coated sutures, and absorbable synthetic materials are increasingly being adopted for their benefits in reducing infection rates, promoting healing, and minimizing the need for suture removal post-operation.

In recent years, there has also been an increase in the development of bioactive and drug-eluting sutures. These are embedded with pharmaceutical agents that actively support healing and minimize complications by delivering therapeutic compounds directly to the wound site. Such innovations provide significant value, particularly for patients undergoing high-risk surgeries or those with compromised immune systems, and they represent a growing niche within the larger market for surgical sutures.

Regional Trends and Market Expansion

The market for surgical sutures is expanding geographically, with significant growth anticipated in both developed and developing regions. North America and Europe have historically led in terms of market share due to advanced healthcare systems, high healthcare spending, and the presence of established industry players. However, emerging economies, particularly in Asia-Pacific and Latin America, are witnessing a notable increase in demand for surgical sutures, driven by improving healthcare infrastructure and rising healthcare expenditure. The proliferation of private hospitals and medical tourism in countries like India, Thailand, and Mexico has created new opportunities for manufacturers.

Governments in these regions are investing heavily in healthcare to increase access to quality medical care, which includes the provision of necessary surgical supplies. Additionally, the growing prevalence of chronic diseases in these regions further fuels demand for surgical procedures, thereby propelling the need for sutures. As more patients seek specialized medical care, the demand for sophisticated surgical products, including advanced suture technologies, is expected to rise.

Competitive Landscape and Strategic Focus

The surgical sutures market is competitive, with both established companies and newer entrants vying for market share through product innovation and strategic partnerships. Major players are focusing on developing new suture materials, enhancing suture performance, and broadening their product portfolios. Companies are investing in R&D to introduce unique features like self-retaining barbed sutures, which improve tissue closure without requiring knots, thereby reducing surgery time and potentially lowering infection risks.

Mergers and acquisitions remain a popular strategy among market leaders to enhance their product lines and expand their market presence. Partnerships with hospitals and healthcare facilities also allow companies to strengthen their distribution networks and increase brand visibility. Some companies are also focusing on eco-friendly sutures, as environmental concerns influence purchasing decisions, particularly in regions with stringent sustainability regulations.

Challenges and Opportunities in the Market

While the surgical sutures market presents numerous growth opportunities, it also faces challenges. The increasing popularity of alternatives to sutures, such as surgical staples, adhesives, and tissue sealants, could impact market growth. These alternatives often offer benefits like reduced scarring, quicker application, and less postoperative pain, making them appealing to both patients and surgeons. However, sutures continue to be preferred for certain surgeries due to their reliability and superior wound closure strength, ensuring their relevance.

Regulatory compliance remains another key challenge. Sutures, being classified as medical devices, are subject to stringent regulatory standards. Companies must navigate complex approval processes in different regions, which can increase time-to-market and associated costs. Despite this, the focus on patient safety and product efficacy ultimately enhances the reputation and trust in suture products, helping to drive sustained demand.