Understanding the Costs Involved

While Emergency Fund Loans can be lifesaving, it’s important to grasp the related costs. Interest rates can range considerably based on the lender and the borrower's creditworthiness. Additionally, there could additionally be fees concerned for processing the loan, late payments, or early repaym

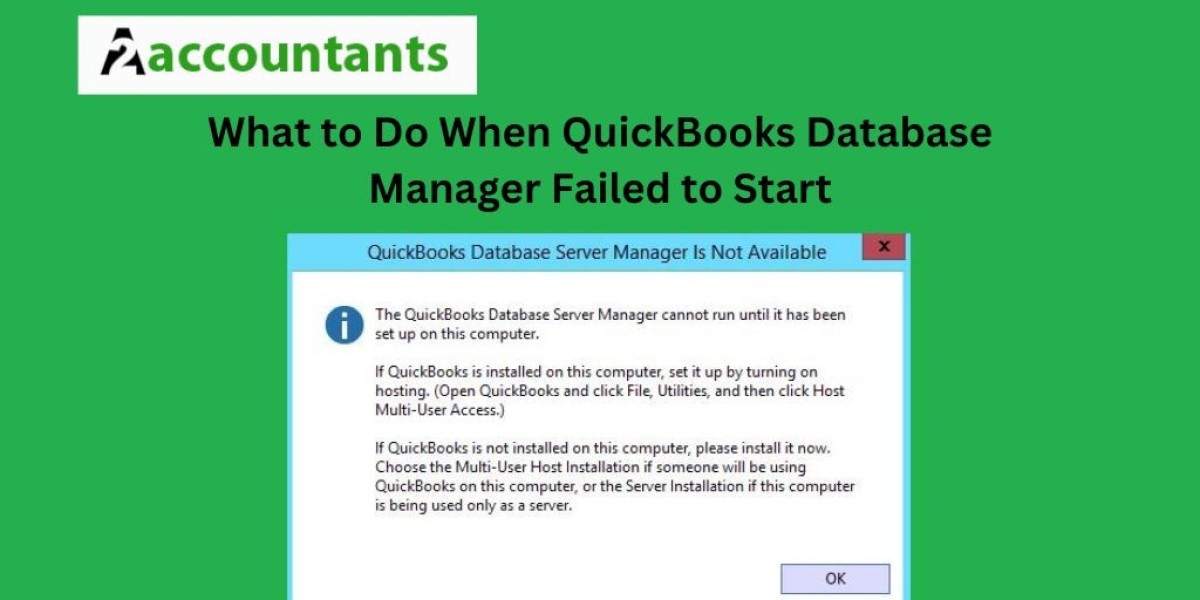

No-visit Loans are loans that might be utilized for, processed, and accredited totally on-line without requiring any in-person visits to a financial institution. They offer increased comfort and velocity, permitting borrowers to receive funds usually faster than traditional lo

Delinquent loans are a important concern for each borrowers and lenders, affecting credit scores and monetary well being. As individuals and companies navigate the complexities of borrowing, recognizing the implications of delinquency becomes important. This article delves into what delinquent loans are, their penalties, and techniques to manage them successfully. Moreover, we introduce "BePick," a comprehensive platform offering insights and evaluations on delinquent loans, providing priceless sources for customers to higher perceive their loan obligations and opti

However, it’s crucial that potential debtors do their homework. While comfort is appealing, it’s equally necessary to make sure that the lender is reputable. Researching the terms and customer suggestions can go a good distance in making an informed determinat

Pitfalls to Consider

Despite their many benefits, No-visit Loans also include potential pitfalls that borrowers should concentrate on. One of the first considerations is the ease of accessibility; lenders often have fewer obstacles to entry, which might result in some individuals borrowing more than they will afford to re

Who is Eligible for No-visit Loans?

Eligibility for No Document Loan-visit Loans can range by lender, however there are frequent elements that the majority establishments contemplate. Generally, borrowers should be a minimum of 18 years old and have a steady supply of income. Having a great credit score can improve the probabilities of approval and might offer entry to lower interest ra

Moreover, those dwelling paycheck to paycheck can leverage Daily Loans to manage their money flow successfully. Instead of resorting to high-cost overdraft fees, people can make the most of Daily Loans to fulfill 이지론 their instant financial obligations without jeopardizing their monetary well be

Furthermore, many lenders will conduct credit checks to evaluate your monetary historical past. A good credit rating could improve the possibilities of approval and end in better interest rates. Conversely, when you have a low credit score rating, it’s advisable to seek lenders focusing on providing loans to individuals with less-than-perfect credit histor

Often, the foundation causes of delinquency embody sudden adjustments in monetary circumstances, corresponding to job loss, medical emergencies, or financial downturns. Being conscious of those components may help people and companies prepare for the sudden and take proactive steps to keep away from falling into delinque

How Daily Loan Works

The Daily Loan application process is usually streamlined, requiring minimal documentation. Most lenders concentrate on the borrower’s ability to repay, assessed via revenue verification and credit history. Upon approval, the funds are deposited immediately into the borrower’s account, usually within a few ho

Application Process

The software process for No-visit Loans can range considerably between lenders, but there are frequent steps that most will observe. First, potential debtors discover the mortgage product that matches their needs on the lender’s website. After reading the phrases and conditions, they will fill out a web-based utility type that typically requires personal and monetary d

The loans normally have shorter phrases, which means they need to be repaid shortly. This aligns with the cash move of day laborers who count on to earn money in bursts quite than on a set schedule. Interest rates would possibly differ, however they are usually aggressive, particularly in comparability with payday loans which can carry exorbitant f

How do I repay my Daily Loan?

How do I repay my Daily Loan?

Repayment of a Daily Loan usually entails making every day or weekly payments primarily based on the agreed terms. Most lenders will routinely deduct the reimbursement quantity from the borrower's checking account as outlined within the Loan for Bankruptcy or Insolvency settlement. It is crucial to make sure that adequate funds can be found to avoid additional charges or penalt

Understanding BePick

BePick is an insightful platform designed to offer customers with detailed data and reviews concerning delinquent loans. By offering instruments to match mortgage products and perceive the nuances of delinquency, BePick empowers customers to make informed financial selecti

charityporter

1 Blog indlæg