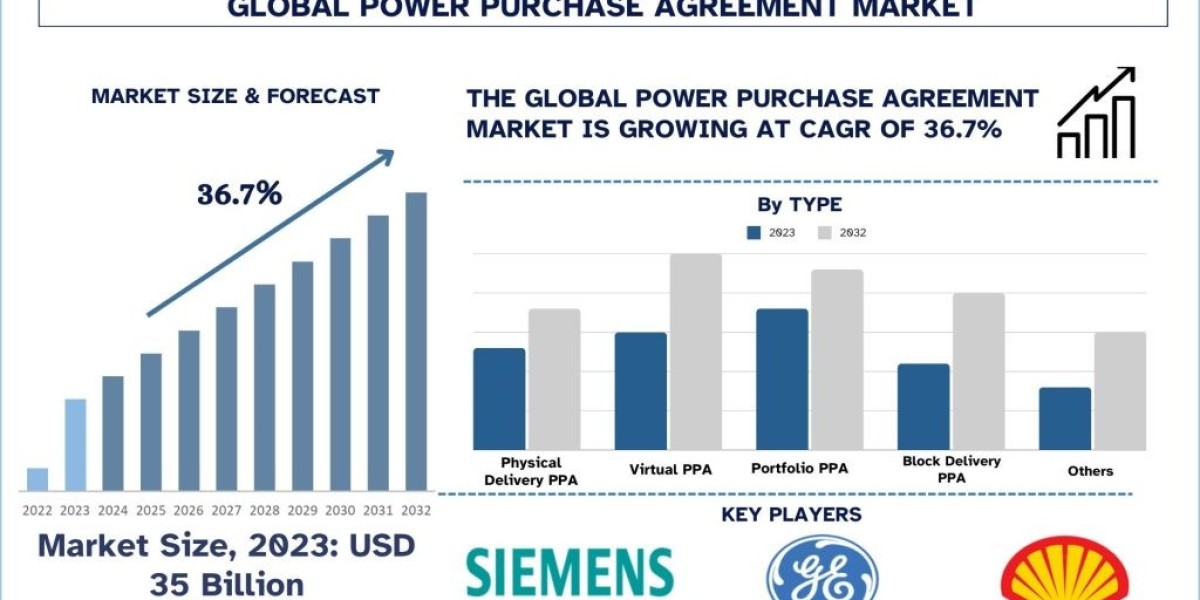

According to the UnivDatos Market Insights, “power purchase agreement Market” was valued at USD 65,959.9 Million in 2023 and is expected to grow at a strong CAGR of around 23.1% during the forecast period (2024-2032). The market of Power Purchase Agreements, also known as PPA, has been growing actively and transforming at an international level. With the growing realization of the need to utilize renewable energy, PPAs have become an essential mechanism through which firms and governments can guarantee the availability of power. There has been a convergence of progressive changes for the PPA market in recent years as indicated by policy shifts, and technological and corporate social responsibility perspectives.

Access sample report (including graphs, charts, and figures): https://univdatos.com/get-a-free-sample-form-php/?product_id=63980

Increase in corporate renewable power purchase agreements:

There is a clear trend towards much higher levels of corporate renewable PPAs being signed as of late. Businesses are already starting to adopt sustainability strategies which have resulted in the push for the utilization of renewable energy. In 2022, there was a sequential string of PPAs that Amazon unveiled to be of 3. 5 GW of renewables installation in several projects all over the world. This action makes Amazon one of the world’s biggest corporate buyers of renewable power pointing out the increasing role of technology firms in the energy market.

Likewise, Microsoft has been adding more renewable energy in the form of PPAs as the main way of acquiring the energy. In 2023, the firm entered a 500MW power purchase agreement PPA with Ørsted, a global power company involved in renewable energy to buy power from an offshore wind project in the United States. It should be noted that such an agreement expresses the commitment of large companies to change the world and switch to the use of renewable energy sources.

PPP Policies Favourable to the Development of the PPA Market:

Governments across the world are integrating strategies for the utilization of renewable resources and thus the PPA market. The European Union has been especially busy in this regard. Formally, precisely in 2022, the EU has introduced its ‘Fit for 55’ package that strives to cut Greenhouse Gas Emissions to at least 55% by the year 2030. This initiative contains elements regarding a promotion of the use of PPAs for the acquisition of REs.

Technology and the Combination of PPAs:

In the advancement of the PPA market, technological enhancements are considered to be influential. Thus, the increase of the usage of energy storage in combination with renewable energies initiated the creation of hybrid PPAs. These arrangements include an affinity for solar energy and wind energy as well as battery storage that makes the energy supply more consistent.

In 2023 when Google entered into a with AES Corporation for a project in Chile for hybrid PPA deal. The partnership integrates 80 MW of solar with 25 MW of battery storage guaranteeing the continuous availability of renewable energy for Google’s data centers. It is thought that there would be increased use of hybrid PPAs because corporations are looking for ways to address the variability of renewable resources.

PPA Regional Trends

The various regions, therefore, depict divergent trends in the schemes that surround the PPA market. In Europe specifically, the target has been placed on offshore wind ventures. For example, the United Kingdom has observed a growing trend in offshore wind PPAs. As part of the long-term power purchase agreement in 2022, BP and EnBW can purchase electricity from Ørsted’s Borssele 1 & 2 offshore wind farm in the Netherlands, which is 15 years of fixed-price renewable electricity. As seen in this agreement, offshore wind is playing a progressively significant role in the European market of renewable energy.

In Asia, currently, the PPA market is growing apace, and it can be spoken about in India and Australia. India’s ReNew Power in 2023 secured a 25-year PPA with the Solar Energy Corporation of India (SECI) for a 1. Details of the two gigawatts hybrid renewable energy project. This project incorporates wind, solar, and battery storage demonstrating the Indian Government’s diversification strategy in energy generation.

Australia has also been rather active in the PPA sphere. MacIntyre Wind Farm is one of the largest onshore wind projects in the Southern Hemisphere AGL the Australian energy company entered into a 15-year PPA in the year 2024. This shows the growing prominence of renewable power and Australia’s capability of becoming a significant market in the global PPA almost within the blink of an eye.

Click here to view the Report Description & TOC https://univdatos.com/report/power-purchase-agreement-market/

Challenges in the PPA Market

The PPA market has been experiencing challenges despite the positive trends. Governmental regulations and energy policies may change from time to time which influences the viability of such contracts. The PPA market in some regions is constrained by the instabilities of the regulatory systems that are still in low development. Furthermore, another factor that may hamper the development of PPAs is the financial credibility of off-takers who are the consumers of the energy.

The PPA market, therefore, has a clear direction in terms of shaping its growth in the future and improving its current structure. The PPA market has even more potential from the current status since the market has a steady trend which is the advancement of corporate sustainability, government policies on renewable energy, and technologies. Due to an increasing number of organizations, both corporations and the public sector, understanding the benefits of PPAs, the market should grow very fast. In the past, growth has been identified in the form of more comprehensive and complex structures of PPA types. Heterogeneous PPAs that can address different power demand requirements and risk management will probably gain more popularity. Moreover, the increase in the activities regarding the installation of renewable energy projects in emerging countries will create new PPAs and will contribute to the global energy transition.

In conclusion, it can be stated that numerous changes occurred in the market of PPA from 2022 to 2024 concerning the overall tendencies of the energy industry. PPAs will have continuous relevance in the new world of sustainable energy as the renewable energy sector expands in the future. Under continuous development and favorable policies, the PPA market has the potential for enhanced growth and therefore, it opens up new opportunities for the stakeholders in the international market.

Related Energy & Power Market Research Report

Power Factor Correction Market: Current Analysis and Forecast (2024-2032)

Agrivoltaic Market: Current Analysis and Forecast (2024-2032)

Carbon Offset and Carbon Credit Trading Service Market: Current Analysis and Forecast (2024-2032)

Syngas Market: Current Analysis and Forecast (2024-2032)

Contact Us:

UnivDatos Market Insights

Email - contact@univdatos.com

Contact Number - +1 9782263411

Website - https://univdatos.com/

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/