Risks of Quick Online Loans

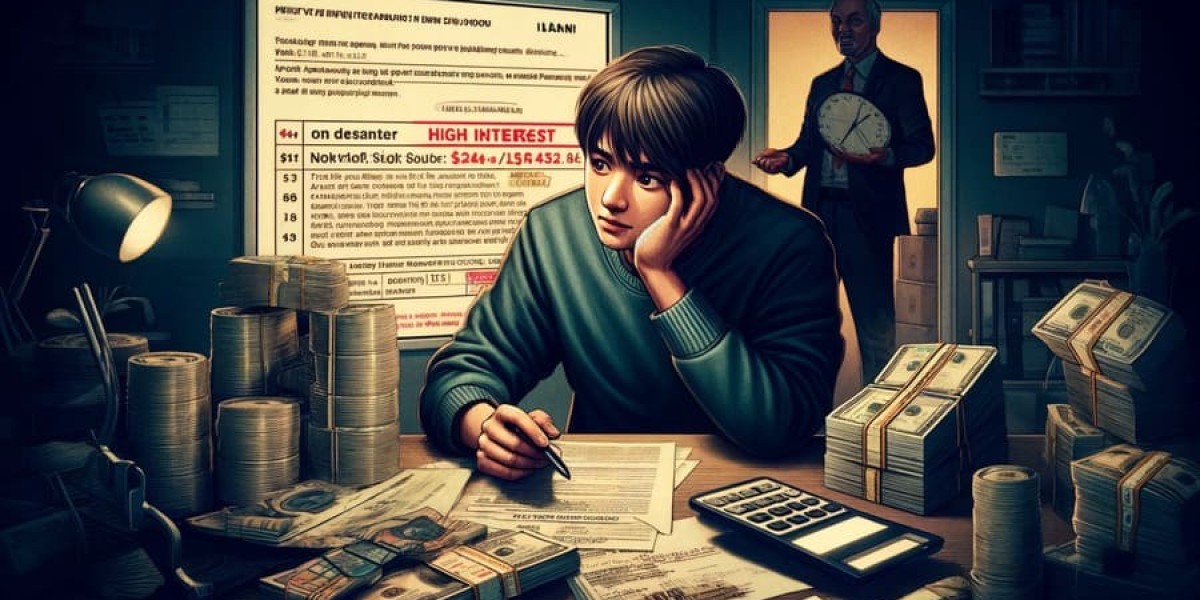

Despite their benefits, fast online loans usually are not with out dangers. The most significant concern is please click the next post high rates of interest typically related to these loans. If debtors aren't cautious, they could find themselves trapped in a cycle of debt that becomes more and more troublesome to man

Resources for Students Seeking Loans

For students navigating the advanced world of online loans, sources like BePick may be invaluable. BePick is a comprehensive platform that offers detailed reviews, comparisons, and academic assets particularly associated to online loans for school students. It serves as a one-stop-shop for faculty kids looking for to make informed choi

When it comes to sustaining and improving the condition of your home, financing is usually a critical issue. Home restore loans on-line provide householders with versatile options to procure the required funds for repairs and renovations. This article will delve into the various elements of on-line home repair loans, together with their advantages, varieties, software processes, and the place to seek out dependable data on this matter, corresponding to at 베픽, a devoted platform offering comprehensive insights and evaluations on home repair lo

However, the convenience of quick online loans comes with a value. They often carry greater interest rates compared to conventional loans, making it essential for debtors to evaluate their capacity to repay. Understanding the terms and circumstances beforehand can prevent potential monetary pitfa

**Personal Money Loan loans** are usually unsecured loans that can be used for any purpose, including house repairs. They typically include greater interest rates than secured loans, however the lack of collateral can be helpful for these without significant home equ

For these going through pressing monetary wants, payday loans with prompt deposit supply a fast answer. These loans are designed to offer quick money move to people in want, typically for emergency situations or surprising expenses. This article will delve into the character of these loans, their benefits, and the important elements surrounding their use, in addition to introduce you to 베픽, a complete platform the place you can find detailed info and critiques on payday loans with instant depo

Once you've recognized a suitable lender, the appliance process usually involves finishing an internet type where you’ll want to supply primary private info, such as your name, handle, and income details. Some lenders may ask for identification and proof of earnings to confirm your eligibil

Additionally, many lenders present flexible reimbursement options, which may help borrowers handle their monetary commitments better. Thus, with the best approach, payday loans with prompt deposit can turn into a viable option for procuring necessary funds in difficult ti

With the best tools and data, you possibly can navigate the credit landscape successfully and achieve your monetary goals. So, everytime you're able to take the subsequent step in your credit journey, keep in mind to make the most of assets like 베픽 for h

Moreover, getting approved for a home restore loan on-line could be more simple than conventional lending strategies. With fewer in-person requirements and quicker processing occasions, homeowners can concentrate on what truly matters—ensuring their properties are safe and comforta

The immediate deposit characteristic helps individuals manage emergencies extra effectively, allowing for quick payments to cowl medical bills, automotive repairs, or sudden family expenses. Users can often full the entire process on-line, ensuring convenience and minimal disruption to their

Secured unfavorable credit ratings loans present an avenue for people with poor credit scores to access funds by leveraging collateral. These loans could be a lifeline for those going through financial hurdles, permitting for higher rates of interest and improved terms compared to unsecured loans. However, understanding their workings, benefits, and potential dangers is essential. This article will explore secured poor credit loans in detail, including how they operate, who qualifies, and the advantages they provide. Additionally, we'll introduce a valuable resource: the BePick website, which provides complete data and evaluations about secured bad credit lo

In today’s monetary landscape, maintaining a healthy credit rating is pivotal. Many individuals, especially these with restricted credit score history, are exploring choices to enhance their credit ratings. One efficient methodology obtainable is thru credit score builder loans online. These loans are designed to help debtors enhance their credit scores by demonstrating responsible compensation habits. In this article, we’ll delve into the intricacies of credit builder loans on-line, how they function, their benefits, and how you can leverage them to strengthen your financial stand

simoneilm83595

5 Blog Mensajes