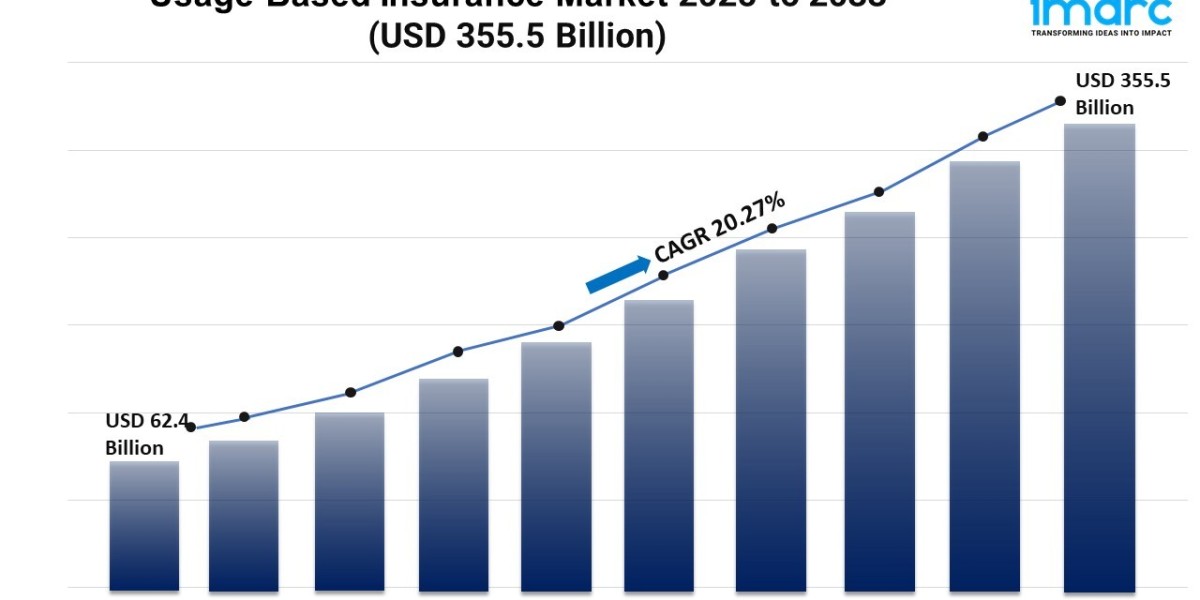

IMARC Group's report titled "Usage-Based Insurance Market Report by Type (Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD), Manage-How-You-Drive (MHYD), and Others), Technology (OBD II, Black Box, Smartphones, and Others), Vehicle Type (Light-Duty Vehicle (LDV), Heavy-Duty Vehicle (HDV)), Vehicle Age (New Vehicles, Used Vehicles), and Region 2025-2033". The global usage-based insurance market size reached USD 62.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 355.5 Billion by 2033, exhibiting a growth rate (CAGR) of 20.27% during 2025-2033.

For an in-depth analysis, you can refer sample copy of the report: https://www.imarcgroup.com/usage-based-insurance-market/requestsample

Factors Affecting the Growth of the Usage-Based Insurance Industry:

- Technological Advancements:

Technological advances in telematics and IoT devices are boosting market growth. Telematics systems in cars or smartphone apps gather data on speed, braking, and mileage. This data lets insurers set premiums based on actual driving, improving risk assessment. Moreover, advances in data analytics and AI help insurers analyze large data sets. This leads to better underwriting and more personalized insurance.

- Demand For Personalized Insurance:

People increasingly want to save money and get personalized insurance. Usage-Based Insurance (UBI) lets drivers lower their premiums by driving safely. This appeals to those seeking fair and transparent pricing. Moreover, trends like car-sharing and ride-hailing boost the demand for flexible insurance. Such insurance adapts to how much people use their cars. Additionally, UBI programs offer control and insights. Drivers can see their habits and understand how these affect costs.

- Insurance Industry Dynamics:

Insurers aim to stand out and gain a market edge. Usage-Based Insurance (UBI) offers personalized premiums based on driving behavior. This attracts those who value fairness and transparency. Moreover, UBI improves risk assessment, leading to accurate pricing and fewer losses. Its data-driven approach also enhances claims management. Real-time data aids in understanding accidents and speeds up claims.

Leading Companies Operating in the Global Usage-Based Insurance Industry:

- Aioi Nissay Dowa Insurance UK Ltd

- Allianz SE

- Allstate Insurance Company

- American International Group Inc.

- Assicurazioni Generali S.p.A.

- AXA

- Liberty Mutual Insurance Company

- Mapfre S.A.

- Progressive Casualty Insurance Company

- State Farm Automobile Mutual Insurance Company

- TomTom International BV.

- UnipolSai Assicurazioni S.p.A. (Unipol Gruppo S.p.A)

Usage-Based Insurance Market Report Segmentation:

By Type:

- Pay-As-You-Drive (PAYD)

- Pay-How-You-Drive (PHYD)

- Manage-How-You-Drive (MHYD)

- Others

Pay-as-you-drive (PAYD) represents the largest segment as it allows policyholders to pay premiums based on the distance driven.

By Technology:

- OBD II

- Black Box

- Smartphones

- Others

Black box holds the biggest market share, which can be attributed to the increasing incorporation of the Internet of Things (IoT) in passenger and commercial vehicles.

By Vehicle Type:

- Light-duty Vehicle (LDV)

- Heavy-duty Vehicle (HDV)

Light-duty vehicle (LDV) accounts for the largest market share due to the escalating demand for cost-effective and reliable insurance solutions.

By Vehicle Age:

- New Vehicles

- Used Vehicles

New vehicles exhibit a clear dominance in the market, driven by the rising preferences for personalized insurance solutions among individuals.

Regional Insights:

- North America: (United States, Canada)

- Asia Pacific: (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe: (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America: (Brazil, Mexico, Others)

- Middle East and Africa

North America enjoys the leading position in the usage-based insurance market, which can be accredited to favorable government initiatives about road safety.

Global Usage-Based Insurance Market Trends:

Collaborations between insurance companies, telematics service providers, automakers, and technology firms are bolstering the market growth. Partnerships allow insurers to access advanced telematics platforms, expand their user base, and enhance the overall experience and satisfaction of individuals.

In addition, UBI offers innovative insurance products that align with the evolving preferences and behaviors of individuals. By leveraging telematics technology and data analytics, insurers can develop UBI programs that reward safe driving behaviors, offer personalized premiums, and provide enhanced driving experiences. These initiatives not only attract new individuals but also foster loyalty and retention among policyholders.

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145 | United Kingdom: +44-753-713-2163